Ubisoft's Trading Halt: Smoke and Mirrors, or Fire Sale?

The sudden trading halt on Ubisoft shares has sent predictable tremors through the market. On November 13th, the company announced a postponement of its half-year FY2025-26 results, prompting Euronext Paris to suspend trading of both shares and bonds. CFO Frédérick Duguet, in an internal memo, cited a need for "extra time to finalize the closing of the semester" and framed the suspension as a measure to "limit unnecessary speculation."

But does it? Or is this a prelude to something bigger?

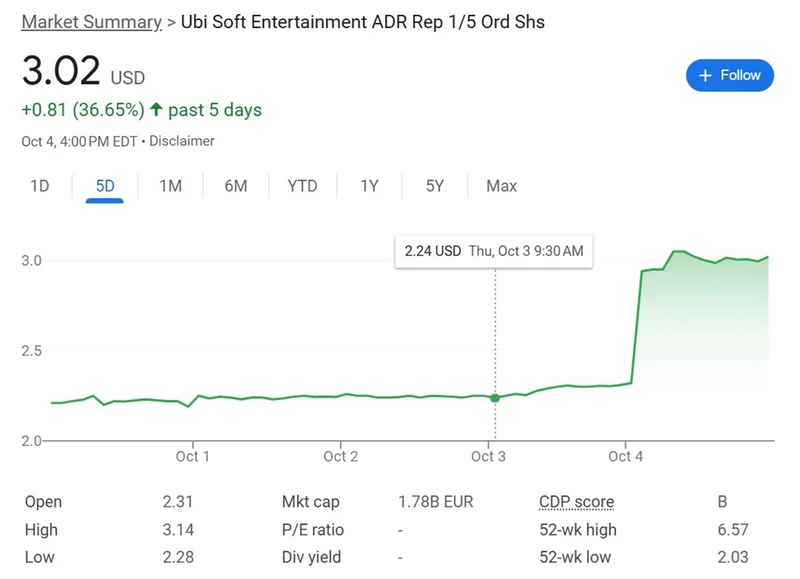

Analysts are understandably skeptical. NotebookCheck points to project cancellations (a post-Civil War Assassin's Creed, Project Scout, and a new Splinter Cell) and leadership shakeups as signs of deeper instability. Investing.com notes a roughly 50% year-to-date decline in Ubisoft’s Paris-listed shares before the halt, suggesting investor confidence was already wafer-thin. The question is whether this is a temporary blip or the start of a more serious downturn.

The juiciest speculation revolves around a potential acquisition. Tech4Gamers, citing an insider, reports claims of "serious M&A discussion" with a non-US buyer, specifically mentioning Tencent and Sony. Tencent already holds a 25% stake in Ubisoft's Vantage Studios IP subsidiary (home to Assassin's Creed, Far Cry, and Rainbow Six Siege), making them a logical contender.

But let’s unpack this. If Tencent were to acquire Ubisoft, what would they be getting? Vantage Studios is already partially theirs. The remaining assets become less appealing if you consider the ongoing restructuring, job cuts at Ubisoft Reflections, and the general market pressures highlighted by Ubisoft UK’s warning of declining sales. Are we talking about a fire sale of distressed assets, or a strategic play for control of a major IP portfolio? The answer likely lies in the unpublished earnings report.

And this is the part of the report that I find genuinely puzzling. Duguet's email to staff, leaked to Kotaku, claims the halt is to "limit unnecessary speculation." But halting trading minutes before an earnings call? That's not limiting speculation; that's inviting it. It's like telling people not to think about a pink elephant. The very act of trying to suppress information amplifies the perception of a problem. Ubisoft Just Did Something Extremely Weird

Beyond the financial maneuvering, there’s the Anno 117: Pax Romana AI art debacle. The game itself is receiving positive reviews, with Business Today calling it a "sumptuous Roman sandbox." But the inclusion of AI-generated loading screen art – complete with the telltale warped hands and missing limbs – has ignited a firestorm of criticism. PC Gamer reports fans are delaying or cancelling purchases, citing a loss of trust in the game’s art pipeline.

Ubisoft's response – that the AI art was a "placeholder asset" that slipped through due to a "review oversight" – is, frankly, insulting. It suggests a level of incompetence or indifference that's hard to reconcile with a company of Ubisoft's size and experience. Even if true, the damage is done. The perception that AI is being used to cut corners, even in seemingly minor areas, undermines the value proposition of a premium gaming experience.

The community reaction is split, but the trend is worrying. While some players still find the game visually stunning, others argue that the AI assets disrespect the work of human artists. This isn't just about one loading screen; it's about the broader question of how Ubisoft intends to balance creative vision with cost-cutting measures. Will they be transparent about AI usage, or will they continue to downplay its role?

Ubisoft is caught in a perfect storm: financial uncertainty, acquisition rumors, and a PR crisis over AI. While Rainbow Six Siege's esports success and Black Friday discounts offer temporary relief, the underlying issues remain. The trading halt, intended to calm the waters, has only amplified the noise. Until Ubisoft releases its delayed earnings report and provides a clear path forward, the speculation will continue. The question isn't just whether Ubisoft is for sale, but whether it can regain the trust of its investors and its players.