Okay, folks, buckle up, because the IRS just dropped some news that's got me genuinely excited! They've upped the 401(k) and IRA contribution limits for 2026, and while it might seem like just another bureaucratic adjustment, trust me, this is a big deal. IRS announces 2026 401(k) contribution limits, raises savings cap

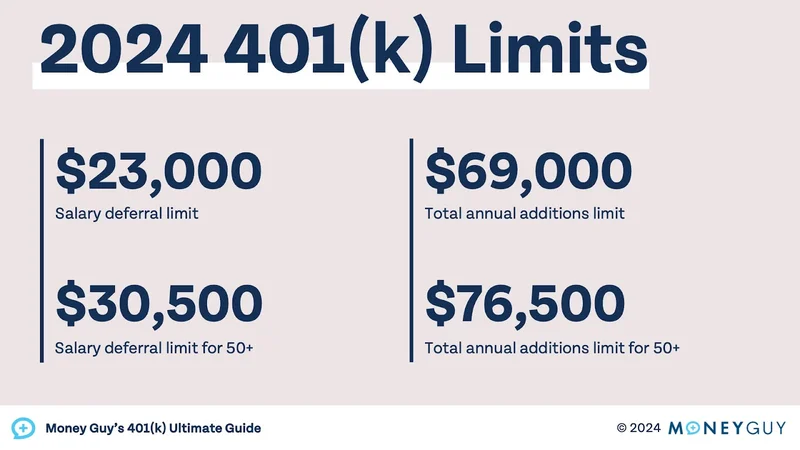

For those of us diligently squirreling away money for our golden years, this is practically a free pass to accelerate our savings. The 401(k) limit jumps to $24,500, a cool $1,000 increase. And for the IRA, we're looking at $7,500, up $500. Now, I know what some of you might be thinking: "Aris, it's just a few extra bucks. What's the fuss?" Well, let me tell you why this seemingly small change can have a monumental impact.

Think of it like this: imagine you're filling a bathtub with a leaky faucet. Every drop counts, right? These increased contribution limits are like turning up the water pressure. We're not just adding a little more water; we're significantly speeding up the filling process. And in the long run, that can mean the difference between a comfortable retirement and… well, something less comfortable.

But here's where it gets really interesting. We're talking about the magic of compounding. It is like the old story of the guy who asks for rice, and the king said yes. The guy asked for one grain of rice on the first square of a chessboard, two on the second, four on the third... and so on. By the end, the king didn't have enough rice in his kingdom to pay him. The earlier you start, and the more you can contribute, the more time your investments have to grow exponentially. Those extra contributions in 2026? They're not just sitting there; they're working for you, generating even more wealth over time. It’s not just about the raw numbers today; it’s the potential they unlock for tomorrow. What could we achieve if we all collectively maximized these new limits, channeling our resources into a future of financial independence?

And let's not forget about the catch-up contributions for those of us 50 and over. The IRS is giving us an even bigger boost, allowing us to contribute even more to our retirement accounts. For 2026, the maximum contribution amount for those age 50 to 59 will be $8,000, up from $7,500 this year. This means these workers will be able to contribute a total of $32,500 in 2026. I think that is truly awesome!

Now, I know that saving more isn't always easy. Life throws curveballs, and sometimes it feels like we're just barely keeping our heads above water. But even small increases in our contributions can make a difference. It's about making a conscious effort to prioritize our future selves, to invest in our long-term well-being.

There is a super catch-up" provision, workers age 60 to 63 are allowed to contribute up to $11,250 rather than $8,000 this year. That figure will remain the same for 2026, so workers age 60 to 63 will be able to sock away up to $35,750 next year.

I read a comment on a Reddit thread the other day that really resonated with me. Someone said, "Retirement isn't just an age; it's a financial number." And that's so true. It's about having the resources to live the life we want, to pursue our passions, and to enjoy the fruits of our labor.

Of course, with great power comes great responsibility. As we accumulate more wealth, it's crucial to think about how we can use it to make a positive impact on the world. From supporting charitable causes to investing in sustainable businesses, we have the opportunity to create a better future for ourselves and for generations to come.

So, what does all of this mean? It means that the IRS is giving us a golden opportunity to build a more secure and fulfilling future. It's up to us to seize it, to take control of our financial destinies, and to create a world where everyone has the chance to thrive. Let's not let this moment pass us by. Let’s embrace these increased contribution limits and create a future where financial security is within reach for all!